No man knows what to do against the really new.

Ashby

Cybernetics is a transdisciplinary field with many concepts. I’ll concentrate here on just two fundamental principles that are essential in the following context: Ashby’s Law and Beer’s POSIWID.

Ashby’s Law stipulates relevant information advantages (an excess of degrees of freedom) for good decisions.

POSIWID (“the purpose of a system is, what it does”) – in addition to the first law of thermodynamics – considers information asymmetries, too: what matters is not so much what you think or believe, but whether your thinking and believing is empirically relevant and really successful.

Cybernetics is the science of control. In complex systems, it is very difficult to define what constitutes good decisions in each and every case (an example is the systematic failure of centrally planned economies, cf. von Mises: “If socialists understood economics, they wouldn’t be socialists”. And just think about this: not even the Germans could make it work:)).

Complex problems are usually not solved by foolish restrictions. This is why Jeff Booth’s mantra provides a concise example for the result of intelligent systems: “Deflation is the natural state of the free market” (it’s not easy to understand at first glance).

Complex problems, however, can often be solved by dual interpretation (or inversion). While it’s not possible to provide specific decision rules for every eventuality, it is safe to assume that violations of the above cybernetic principles will lead to control failures, especially inefficiency, error, and degeneration.

Control is based on valuations, and much of that can be expressed in monetary units. There have always been many different kinds of money as a basis for the transmission of value.

For example, a direct exchange of goods and services (barter) can be interpreted as money and can be used to organize social systems as far as it is possible to keep track of who owes what to whom.

Robin Dunbar invented the “Dunbar Number” as a cognitive limit in this context (it’s around 150): humans are not very good at remembering such things.

Because humankind didn’t get very far with this cognitive handicap, it eventually invented writing in an accounting(!) context more than 5,000 years ago.

In addition, there have always been commodity moneys, such as jewels or salt. The oldest and most successful commodity money to date is gold: for a long time, gold was also used to back paper money. However, because it is relatively scarce and difficult to handle (among other reasons), gold backing was abolished in the US in 1971.

In such cases of central, unbacked money, we speak of fiat currencies. Their potentially unlimited supply has always been very problematic (see, for example, the publications by representatives of the Austrian School of Economics).

Bitcoin finally emerged from the attempts to solve these problems as an absolutely scarce monetary asset (which is quite an accomplishment when you think about it: Only two things are absolutely scarce, our life time (unless you believe in reincarnation) or Bitcoin).

So many things can be money, but not all money is currency: currencies are political money or legal tender. However, not every currency is good money.

The fundamental problem of every currency system have always been control deficiencies. Usually more and more money is created, which has always lead to inflation (in fact, inflation in its truest sense is nothing other than an increase in the quantity of money). Price indices, on the other hand, primarily describe the price development of arbitrarily selected (and frequently changed) “baskets of goods”, mostly from a politically influenced (and therefore not very reliable) perspective.

As an example, even the fall of Rome was closely linked to the Denarius’ dilution.

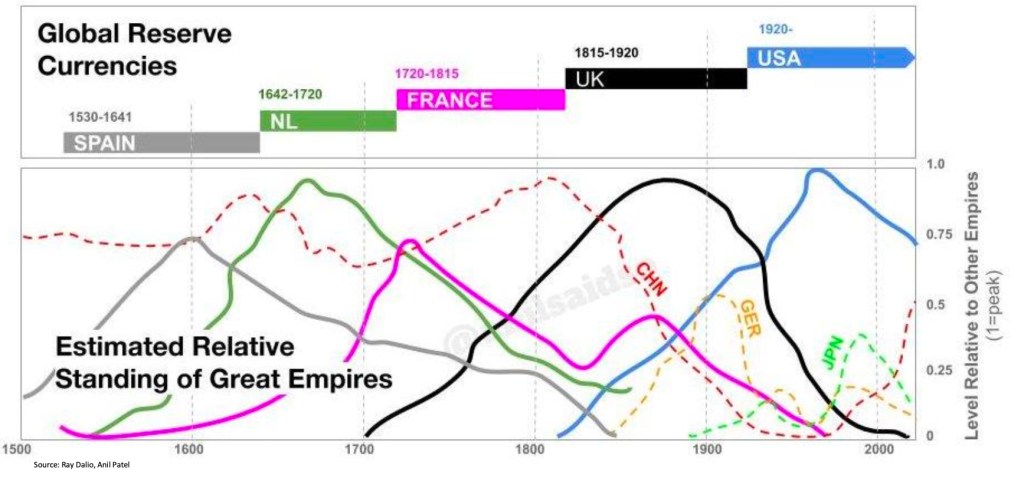

The following graph shows a brief history of world reserve currencies: their average lifespan has been around 100 years so far:

Currently, the US dollar is the dominant world reserve currency, but after 100 years it’s showing signs of weakness. For example, US debt is now over $35 trillion, which seems unsustainable even according to the Federal Reserve (which is, by the way, neither federal nor has it reserves).

Fiat is ultimately debt-based money that isn’t covered by anything (well, in fact just by confidence in a state’s promise of repayment).

However, when government debt reaches a critical level, self-reinforcing debt spirals emerge that can only be controlled to a very limited extent by the usual, rather trivial monetary policy instruments (kicking the can further down the road).

Our international monetary system equilibrium, which is still heavily dependent on the dollar, is therefore becoming increasingly unstable; treasuries are losing their status as safe investment, and the petrodollar system has effectively ended. That also poses major problems for currencies that have benefited from dollar hegemony for more than 50 years.

Although money is one of the most important foundations for the organization of social systems, very few people are even aware of the far-reaching consequences of its deficiencies.

In particular, easy-to-make money has traditionally contributed significantly to the intensification of armed conflicts. So In 1921, Henry Ford pointed out the connection between currency and wars and proposed a thermodynamically sound, energy-backed money as an alternative.

The practical implementation of this idea began in the 1970s with modern cryptography and took over 40 years until Bitcoin’s seminal whitepaper: Bitcoin is the implementation of cybernetically perfect money.

In addition to the cryptographic basis, the triumph of the internet was also an essential prerequisite for its existence:

Cyberspace is Bitcoin’s natural habitat, cybernetics is its natural conceptual basis if you really want to understand its emergent properties, which ultimately lead to its anti-fragile strength.

JP Morgan coined the quote: ‘Gold is money, everything else is credit’. Today, Bitcoin seems increasingly to be taking on this role as (not only) digital gold.

But Bitcoin is, of course, also a highly disruptive innovation with undeniably negative consequences for the traditional systems (and their beneficiaries, if they fail to adapt to the new environment). So this fundamentally new, fundamentally different monetary system threatens very deeply rooted steady-states.

Most interestingly, Bitcoin is greener and better for the environment than other monetary systems could ever dare to dream of, precisely because of its inherently close cybernetic coupling of economics and energy.

In fact, it has a good chance of becoming the first truly emissions-negative industry, which is still largely unknown to the chronically misinformed (and misinforming) media.

Bitcoin has a great variety of positive ecological effects on our natural environment and in the humanitarian field, for example in the context of promoting and stabilizing green energy networks, ensuring financial protection, promotion of economically disadvantaged regions, and many more.

From a cybernetics perspective, Bitcoin actually has the best possible desirable properties (it can even be considered a cybernetic life form in its own right).

One of my favorite quotes by Ashby is: ‘No man knows what to do against the really new’, which has also played an important role in its development. Its system-dynamically emergent properties do not allow for immediate comprehension without appropriate training, which enabled a long, undisturbed ‘flight under the radar’ when its network was still vulnerable.

The intrinsic strengths of the Bitcoin system are an emergent consequence of its design features. It is a perfect combination of components that are weak on their own, but which, in this unique systemic context, complement each other to create a stable, robust and even anti-fragile strength.

Most people have a hard time with understanding emergence, which has favored the development of altcoins even in good faith (not all cryptocurrencies are pump & dump schemes with unregistered securities, some are actually launched with a naive-sincere intention of ‘improving’ Bitcoin): Altcoins (alternative crypto coins) are “cryptos”, but have nothing to do with Bitcoin (well, except for the usual Bitcoin affinity scams). Trying to “improve” Bitcoin while not understanding its systemic properties and focussing on an isolated weakness of one of its components will fail, as more than 20,000 examples have impressively shown so far. But not all altcoin creaters are criminals or “unethical”, many of them simply havent’t understood cybernetics and system dynamics.

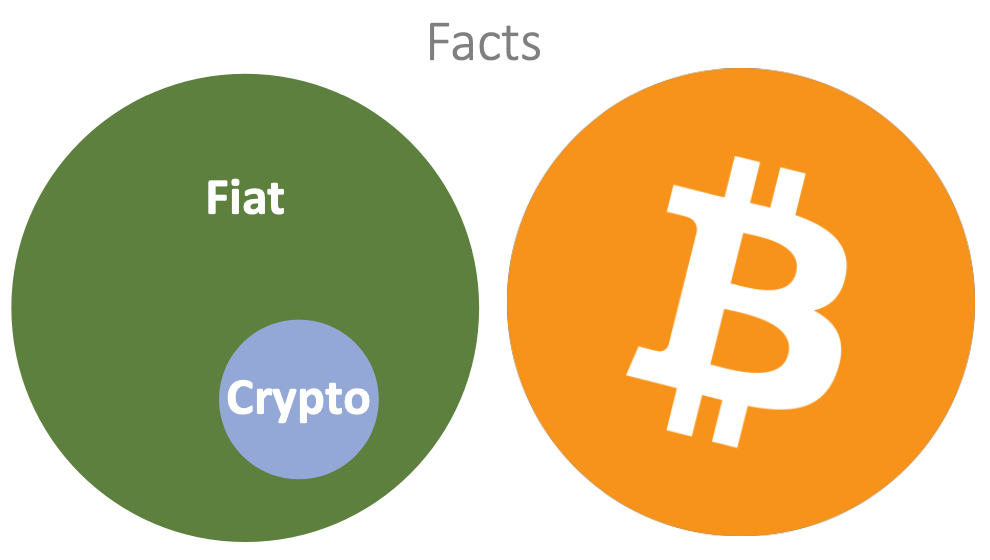

This is how the beginner sees the relationship between fiat currencies and crypto money:

But on closer inspection, crypto money has a lot in common with fiat money, and little or nothing with Bitcoin.

So here are the main differences between the three monetary systems:

⁃ Fiat currencies: the state can print as much money as it wants (which leads to inflation).

⁃ Altcoins (‘Crypto’ in the narrow sense): anyone can print as much money as they want (that’s a huge playground for greater fools and/or fraud). After all, if you are truly a free market advocate, you should perhaps embrace the Darwinian effects of unregistered securities. It was always a bit more expensive to be stupid:

According to the laws of thermodynamics, value does not disappear; it just migrates from weaker to stronger minds.

⁃ Bitcoin: no one can print money (absolute scarcity and thermodynamically as well as ethically sound money).

The essential properties of Bitcoin lead to an adoption dynamic that can best be explained by game theory (Saifedean Ammous: ‘Bitcoin will be adopted like gunpowder: if you don’t own it, you’ll be its victim’). The more Bitcoin is established as a global monetary system and asset (not necessarily currency), the deeper everyone finds themselves in a game-theoretic dilemma.

Its mere existence provides an exit door out of the chronically disparaged fiat currencies.

This is also reflected in the current political and economic developments: 2024 is considered the official start of institutional adoption with the most successful ETF launch of all time.

FASB will allow fair value accounting in the future (instead of at the lower of cost or market, which is very detrimental to corporate investment in the context of highly volatile prices).

Meanwhile, Bitcoin has even become an issue in the US presidential election campaign and as a proposed successor to the petrodollar system to protect and expand dollar hegemony.

It is also being discussed at nation state level as a strategic reserve asset as well as in a geopolitical context (see J. P. Lowery: softwar).

So the geopolitical prisoner’s dilemma can be outlined as follows:

On the one hand, it’s unlikely that Bitcoin can be stopped. On the other, it’s probable that its success will lead to a progressive demonetization of traditional asset classes. Although, with a market capitalization of less than 2 trillion and little more than 200 m estimated global participants, Bitcoin is currently still in its infancy.

Depending on the demonetization scenario, further thousands of percent in value appreciation potential can be assumed. Even 20,000 percent appreciation within 20 years does not seem unrealistic, given the absolute scarcity and specific properties.

Once it was Bitcoin’s strength that it’s rather difficult to understand. Nowadays that’s its main weakness and allows the same, long-disproved criticisms to be repeated over and over again to the woefully misinformed.

In fact, almost everyone is against Bitcoin before they are for it. But with time and understanding, critics later become even more convinced. It’s a race against time, that you’re facing.

This transdisciplinary learning path becomes more and more versatile the more steps you have taken. The learner thus constantly discovers something new, and today there is hardly any other area with a higher marginal utility of learning that can be almost directly converted into monetary value.

But Bitcoin can indeed be a very challenging minefield with a high risk of total loss if you don’t at least understand the basics and don’t follow a few simple rules. They are actually not too difficult to follow once you know them (see the “starter package” section behind the link).

Due to the fundamental and far-reaching influence of monetary systems, there’s a meme according to which ‘Bitcoin fixes everything’. Satoshi Nakamoto limited the money supply to 21, which is, of course, only half of the answer to all questions (42). So Bitcoin doesn’t solve all problems, but it should at least be able to solve almost all monetary problems.

To solve most of the rest, I propose a rational cybernetics, which uses a similarly fundamental, inverse starting point for the basic concept of knowledge or information quality:

Rationality itself can be fundamentally improved by a simple change of perspective, too: in order to draw a defining boundary to knowledge, one must know both sides of this boundary (i.e. one must know what one cannot know). But this inverse interpretation is not enough on its own:

Only with the additional consideration of the empirical phenomenon of Qualitative Passive Disinformation, knowledge quality can be specifically treated and improved, instead of having to get stuck in endless (albeit knowledge-romantic) confusions.

However, far-reaching improvements in the quality of knowledge can be at least as disruptive as a »separation of money and state«: a potential separation of power and collective control systems. Therefore I called it “The Ultimate Taboo”.

Last but not least: The accelerated development of information technology has not only enabled the implementation of Bitcoin, but has also allowed for leaps and bounds in the field of technical cybernetics:

How do you control control systems? That’s the fundamental problem of 2nd order cybernetics.

But there, too, a fundamental change of perspective offers dominantly better and at the same time maximally simplified solutions – up to the integration and coordination of heterogeneous AI systems and a simple implementation of superhumanly plastic neural network architectures: These are enabled to optimize themselves (and each other) during runtime, up to the complete controllability of the largest, most complex artificial brains.

© 2020-2025 Dr. Thomas R. Glueck, Munich, Germany. All rights reserved.